Quantum Field Theory Perspective on the Chinese Economy: A Simplified Case Study

I. Methodological Explanation: Why Use Quantum Field Theory to View the Economy?

Quantum field theory was originally developed to describe the overall behavior resulting from the interactions of a large number of particles in a field, which bears a striking resemblance to modern economies:

- Individuals (enterprises, workers, governments) are vast in number

- Behaviors influence each other and cannot be understood in isolation

- Overall outcomes are often "non-linear" and filled with uncertainty

Therefore, this case study does not employ any physical mathematical formulas but uses quantum field theory as a conceptual tool for understanding complex systems to reinterpret Researcher Lin Tsung-hung's structural analysis of the Chinese economy.

We imagine the Chinese economy as a vast but uneven energy field:

- Trends are "waves"

- Policies are "external forces"

- Population and enterprises are "particles in the field"

- Crises are "unstable states of the field"

II. Assessment of China's Economic Strengths and Weaknesses: Surface Strong Field, Internally Highly Uneven

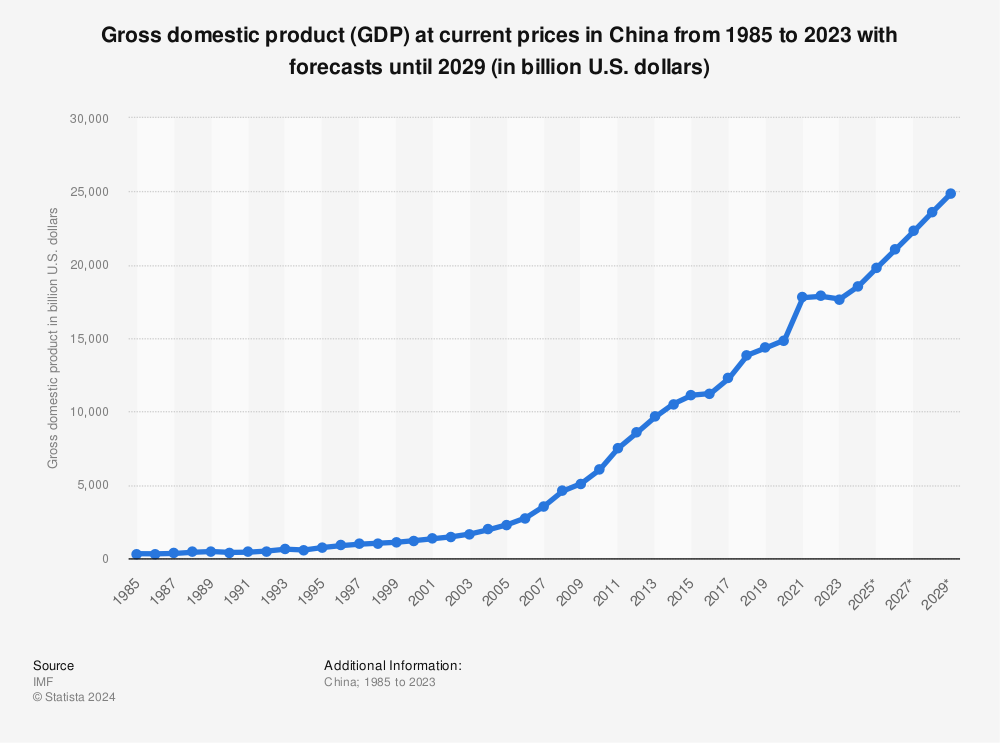

From a quantum field perspective, the Chinese economy presents a field with "very high total energy but extremely uneven distribution."

- Total GDP is like the overall energy amplitude of the field, which is enormous

- Per capita GDP and social welfare reveal large "low-energy zones" within the field

First-tier cities and state-owned sectors are like high-energy dense areas; rural areas, migrant workers, and small and medium-sized enterprises have long been in low-energy states.

The credibility issue with official statistical data can be likened to "measurement uncertainty": the more you try to precisely measure the true state, the more the data itself may be interfered with by institutions and politics. Therefore, Li Keqiang in the past used electricity generation and railway freight volume as alternative indicators, essentially switching to indirect observations to approximate the real field state.

The result is:

- Surface appearance of stability

- Internal undercurrents of deflation and consumption shrinkage, which are the most typical risk signs of "field unevenness."

III. Developmental Stage Transition: From Low-Energy Aggregation to High-Energy Mismatch

China's early "world factory" model can be seen as a low-energy but high-density economic field:

- Cheap labor

- Highly controllable institutions

- Foreign capital surging in like particles

This field state is highly suitable for export orientation but heavily reliant on external demand.

Recent policies attempt to drive transformation, equivalent to forcibly raising the energy level of the field:

- Developing high-tech

- Emphasizing domestic demand

- Massive state subsidies injected

The problem lies in: the field's structure not changing synchronously.

The result is "involution":

- Enterprises interfering with each other rather than complementing

- Price wars consuming energy

- Consumption power unable to transmit effectively

It's like energy being continuously injected but canceling each other out through interference, forming a high-energy-consumption, low-efficiency mismatch state.

IV. Institutional Problems: Long-Term Turbulence Caused by Barriers in the Field

From a field theory perspective, the key issue in the Chinese economy is not just "growth slowdown," but the presence of numerous structural barriers within the field:

- The household registration system is like an impenetrable potential barrier, blocking the free flow of labor

- Resource allocation and corruption cause energy to concentrate at specific nodes

- Real estate bubbles form local overheating, squeezing other industries

In the short term, low human rights and high control can accelerate energy release; but in the long term, it destroys trust, the "cohesive force of the field."

Once trust declines, the field easily enters an irreversible turbulent state.

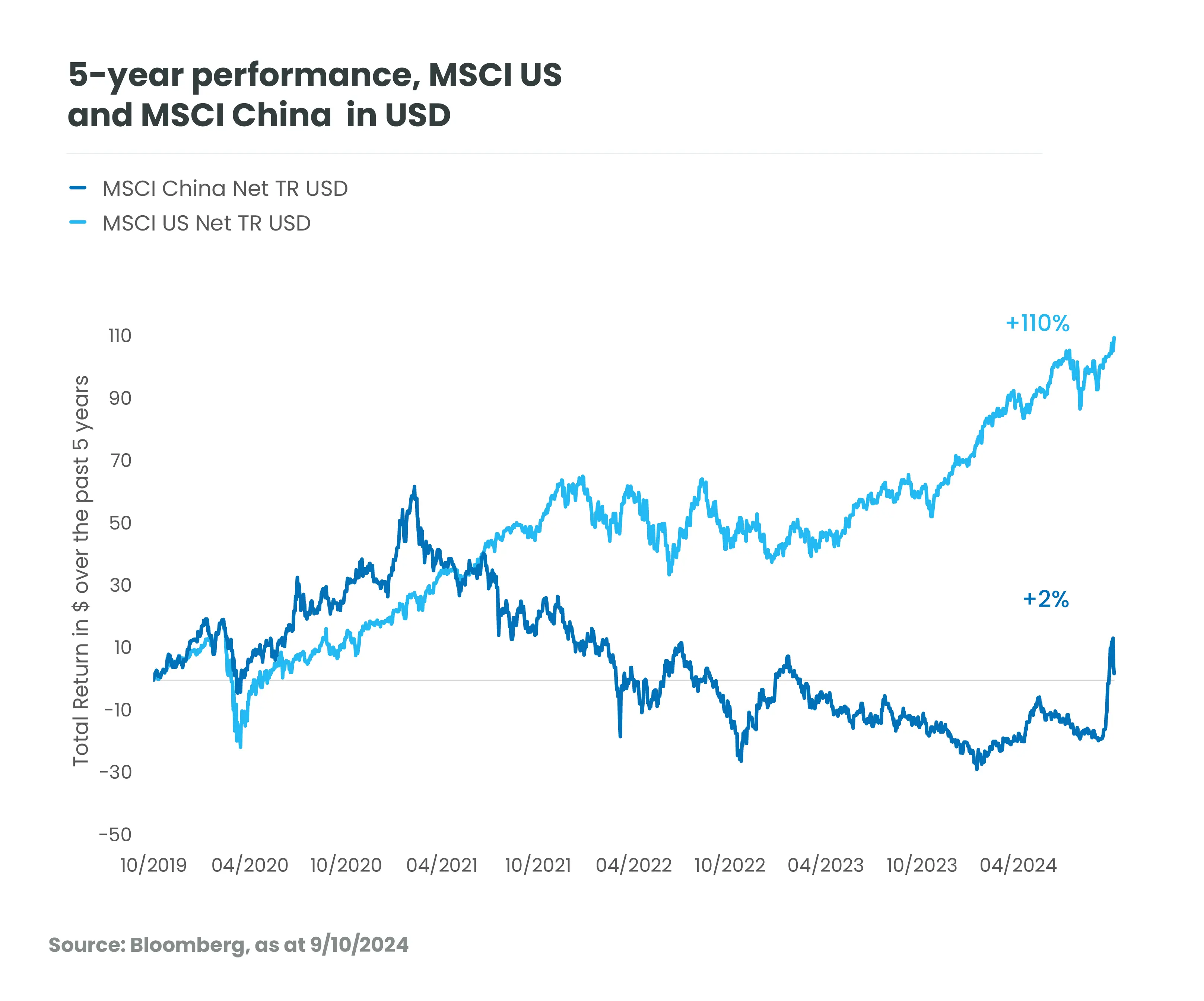

V. Tariff War: External Disturbance Amplifying Internal Instability

The US-China tariff war can be viewed as an external high-energy disturbance:

- Directly impacting the export sector

- Amplifying the dependency on external demand

- Forming a superposition effect with insufficient domestic demand

China attempts to use technological self-reliance as a "self-repair mechanism," but with the field structure unadjusted, repair efficiency is limited.

This shows that the Chinese economy is no longer just cyclical decline but insufficient adaptability of the field state to the new environment.

VI. Impact on Taiwan: Realignment of Coupling Between Fields

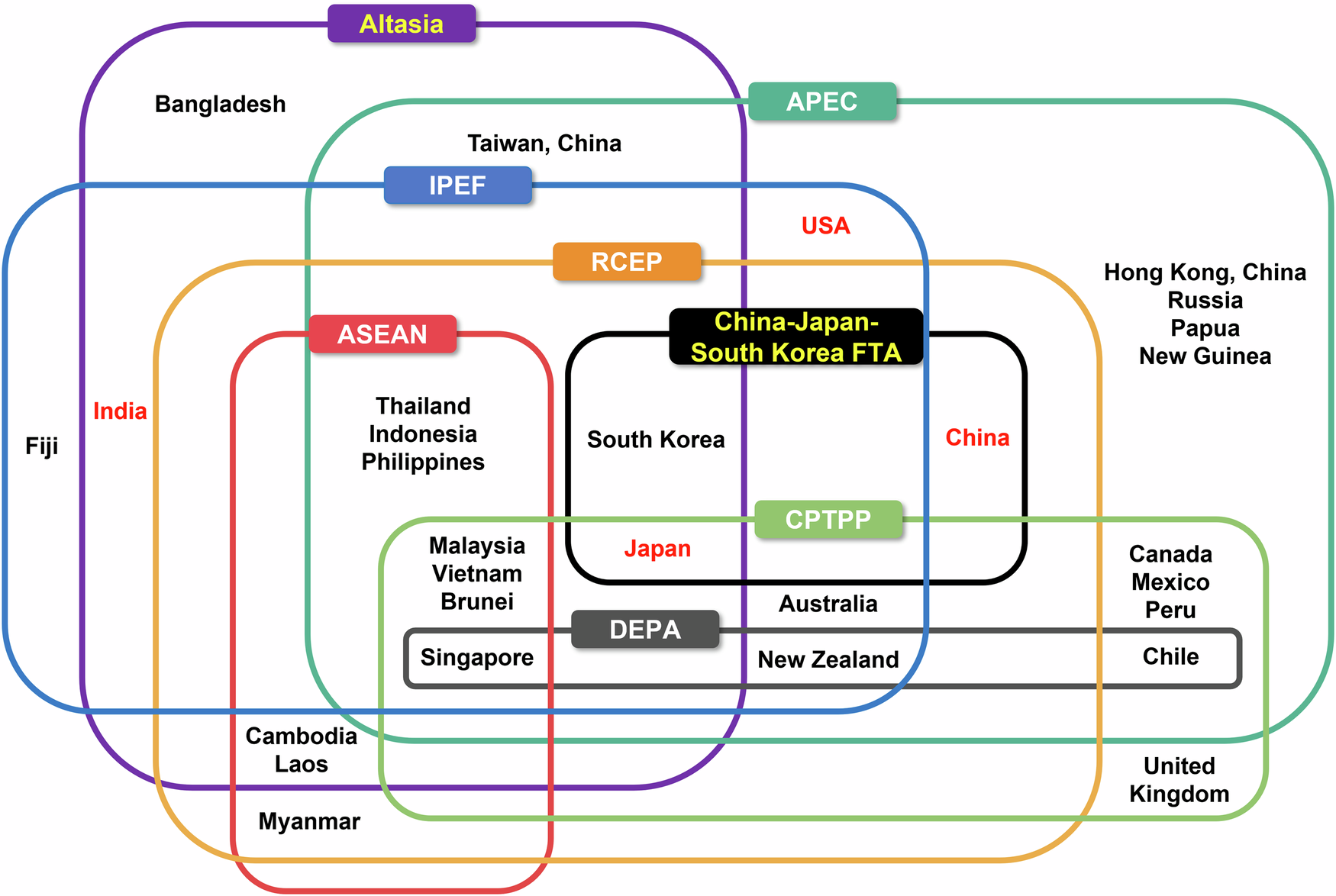

Taiwan and the Chinese economy can be seen as two long-term coupled energy fields.

In the past, they were complementary:

- Taiwan provides high-energy key technologies

- China handles large-scale assembly

Now shifting to competition and cooperation:

- Overlap in technology and markets

- Repulsive effects beginning to emerge between fields

China's economic slowdown, in the short term, causes energy to flow toward Taiwan (order diversion effect); but if China strongly rebounds, it may form rebound pressure.

Therefore, over-reliance on a single coupling partner is equivalent to binding one's own field state to a high-risk oscillation source.

VII. Political Centralization: Structural Fragility Under the Illusion of Stability

High concentration of power is equivalent to resetting the rules of the entire field.

- Short-term improvement in decision-making efficiency

- Long-term reduction in system feedback and correction capabilities

Excluding successors, information opacity, highly personalized policies will cause the entire economic field to lose "elastic modes."

Once the core node has problems, the risk is not gradual adjustment but sudden collapse.

VIII. The Next Decade: Phase Transition Risks Still Unresolved

The key in the future lies not in growth rate figures, but in:

- Whether institutional barriers can be removed

- Whether public trust can be rebuilt

- Whether diverse interactions and feedback within the field are allowed

If the old model is maintained, the economic field will remain in high-energy turbulence long-term; if reforms are possible, it may enter a new stable phase state.

Conclusion: Quantum Field Theory is Not a Prophecy, But a Risk Identification Tool

This case study does not use physics to "explain" the economy but borrows quantum field theory's systemic and interactive views to help us understand why China's economic problems have:

- Concealment

- Non-linearity

- Sudden change risks

This is also the core reminder from Researcher Lin Tsung-hung over the long term: True crises often occur when things seem stable.

:max_bytes(150000):strip_icc()/trade-wars-definition-how-it-affects-you-4159973_color-bf45e3ae6bad40e09e5485c8f6fa7c75.png)

留言

張貼留言