The China Silver Fund Crash of February 2026: A Domino Effect on Global Markets

Introduction

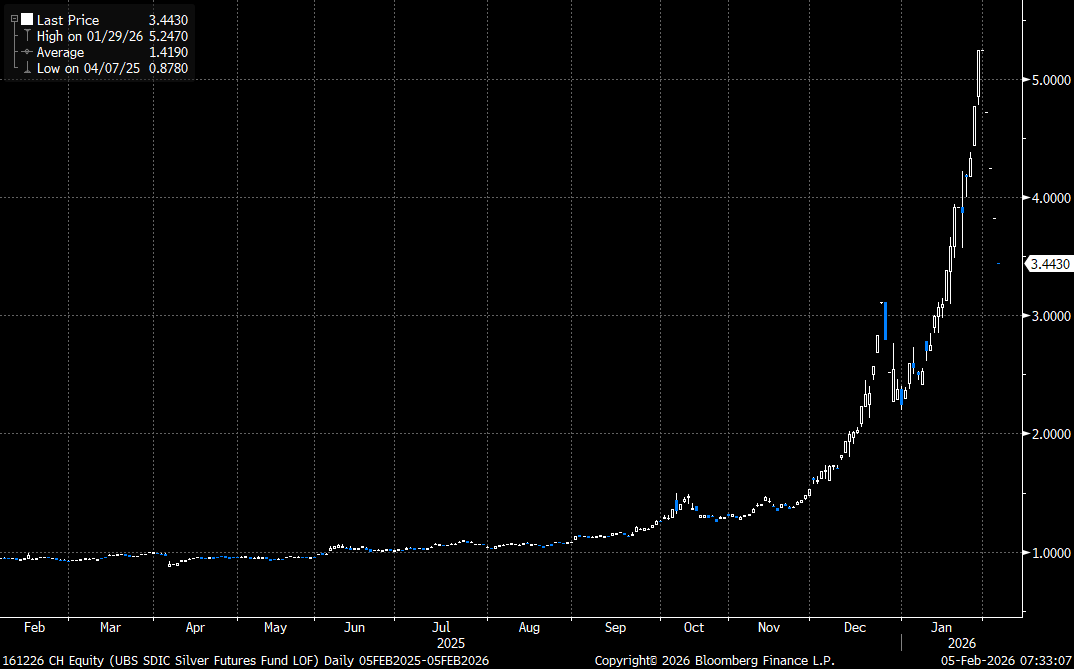

In early February 2026, a seemingly niche event in China's financial markets triggered a widespread panic, leading to sharp declines in silver, gold, Bitcoin, and even U.S. stocks. The epicenter was the UBS SDIC Silver Futures Fund (LOF, code: 161226), China's primary silver-tracking fund, which experienced a historic collapse due to a valuation rule change amid global silver price volatility. This report examines the causes, ripple effects, and key visuals from market charts, while providing actionable investment advice. As of February 7, 2026, the aftermath lingers, with the fund still in liquidity limbo.

The Bubble and the Burst

The crisis began with retail investors in China piling into the 161226 fund, inflating its market price to a 60%+ premium over its net asset value (NAV)—a classic bubble fueled by leverage and speculation. By late January, global silver prices had plunged over 30%, but China's daily 17% drop limit kept domestic futures from fully adjusting. On February 2, the fund operator abruptly revised valuation rules to align with international prices, slashing the NAV by 31.5% in a single day—the largest drop in Chinese public fund history. This led to consecutive limit-down days (10% cap), trapping sellers in a liquidity trap.

The fund's price chart illustrates the dramatic fall:

A longer-term view shows the rapid ascent and crash:

And here's a daily breakdown highlighting the volatility:

Compounding the issue was the timing: just before the Lunar New Year (starting February 15), when investors traditionally cash out for holidays, amplifying sell pressure.

Chain Reaction to Commodities and Crypto

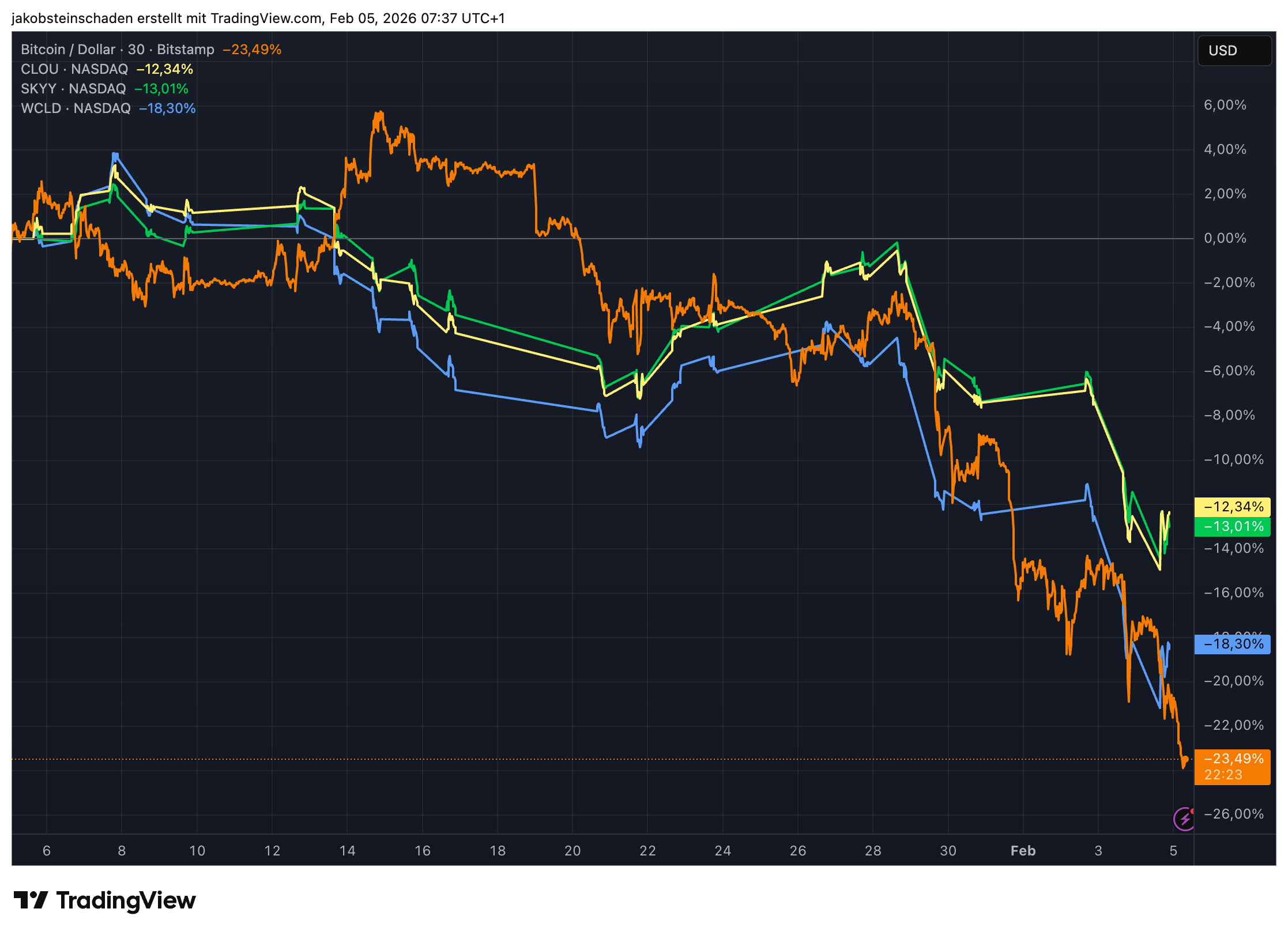

Leveraged investors faced margin calls (T+2 settlement), forcing them to liquidate other assets to cover losses. This domino effect hit gold and silver spot prices hard, with silver flashing down 19-22%. Bitcoin, held by many Chinese via underground channels, OTC trades, or Hong Kong ETFs, suffered a correlated crash as panicked sellers dumped liquid holdings.

Gold and silver price trends show the synchronized drop:

Diversified metal ETFs also reflected the pain, though less severely:

Bitcoin's plunge, down 23%+ in days, is captured here:

And a shorter-term Bitcoin chart emphasizes the February freefall:

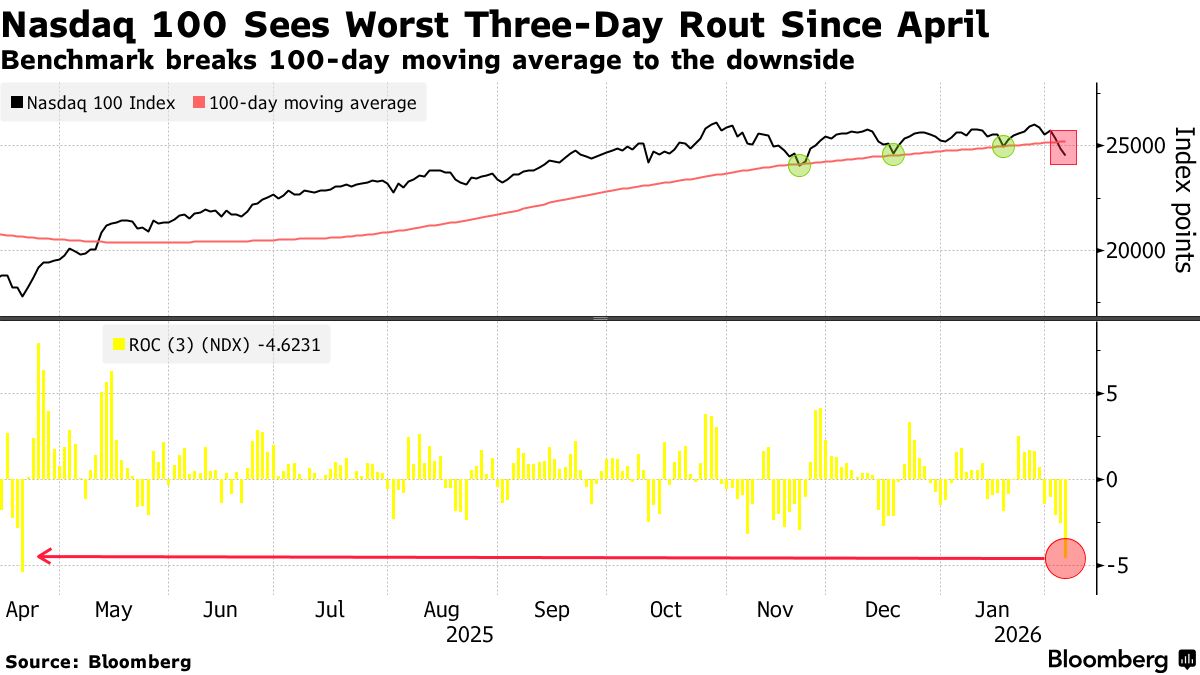

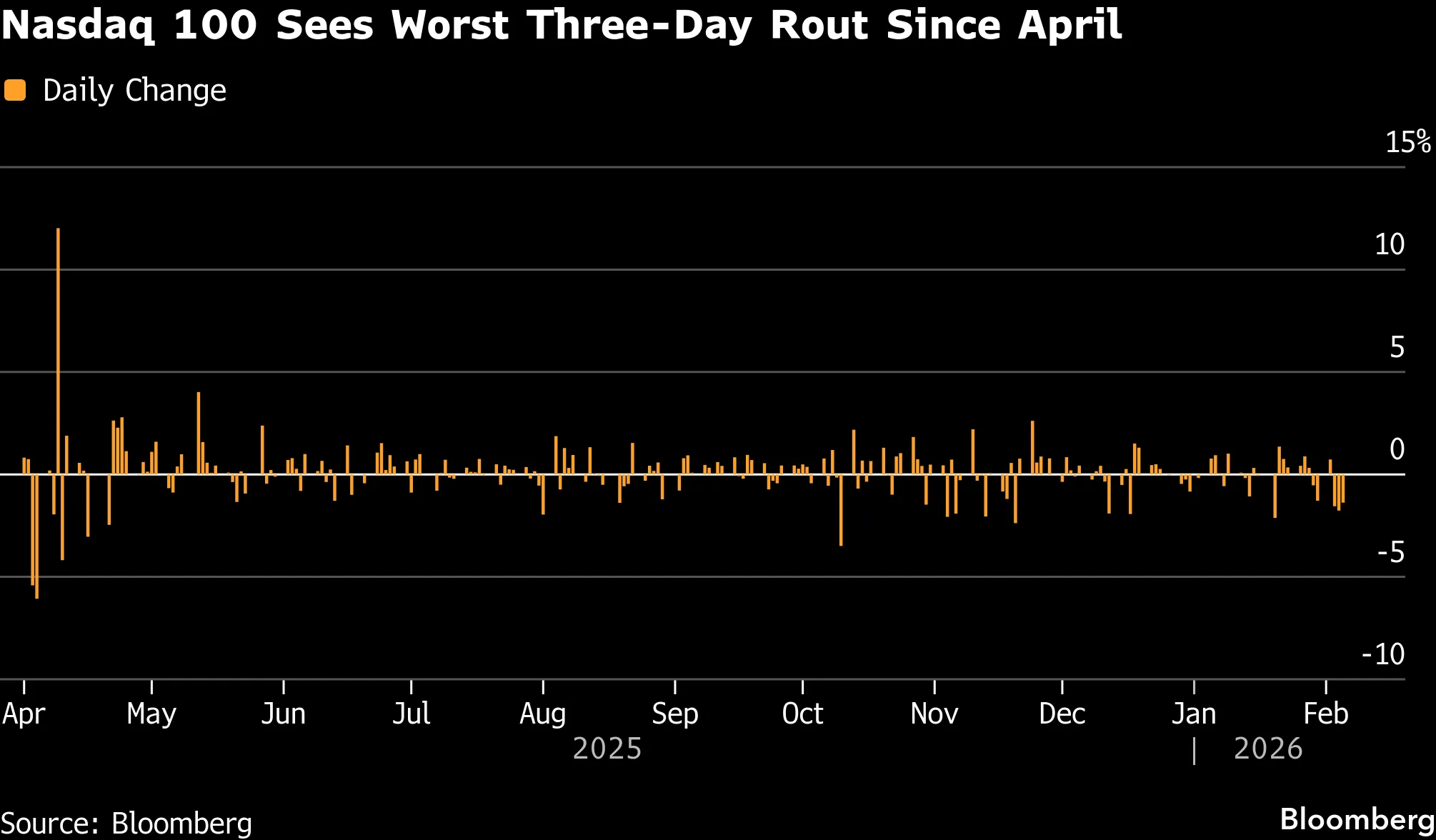

Impact on U.S. Stocks

The contagion spread to U.S. markets, with Nasdaq dropping 1.41% on February 5 amid broader risk-off sentiment. Alphabet (Google) earnings beat expectations but shares fell 7.5% due to massive $175-185B AI capex plans, raising overinvestment fears. Weak job data (December vacancies at 2020 lows) added to the selloff.

Nasdaq's three-day rout is evident in this chart:

Daily changes further highlight the decline:

On the evening of February 7, 2026 (it's past 10 PM now), silver and Bitcoin are really staging a violent V-shaped reversal! Within 24 hours, silver surged nearly 22% at one point, and Bitcoin followed with a 13-17% rally. Shorts got brutally liquidated (crypto market 24-hour liquidations exceeded $500 million, maybe even higher).

Investment Recommendations

- Short-term (this week to next week): Don't rush to chase the highs! This V-reversal is super violent, but it's still a "falling knife rebound." Set solid stop-losses (silver breaking below $70, Bitcoin breaking below 68k → run for the exits).

- Medium-term: If it holds the lows, you can pick up small amounts (Bitcoin below $70k in batches, silver below $80 via ETFs like SLV). Silver looks strong long-term (industrial + safe-haven demand), Bitcoin tied to the halving cycle.

- Risks: Volatility is extreme ahead of delivery/expiry months. Keep leverage no higher than 2-3x, diversify (don't go all-in), watch USD movements + Fed news.

- Most important: Market sentiment is extreme right now (fear ↔ greed flip-flopping). Following the crowd is the most dangerous move. Do your own research + set stop-losses, or you'll end up as cannon fodder.

- This rally is insanely exciting! Is it a bull trap to lure longs, or the start of a true reversal takeoff?

A huge portion of asset prices has been supported by cheap funding and refinancing expectations, rather than being fully grounded in sustainable productivity improvements. The global economy is experiencing a structural transition—from liquidity-fueled asset inflation to repricing constrained by actual cash flows.

Right now (evening of 2026/2/7), the funds haven't fully stabilized yet—keep observing!

留言

張貼留言